In traditional business accounting, all that mattered was the bottom line. That profit - loss entry materialized all that was needed to guide an investment or to structure a company’s strategy and management. However, this is no longer true.

Other metrics are becoming more relevant to financial investments and to corporate management, since they indicate either very real risks or promising opportunities. Metrics involving environmental concerns are currently one of the most sought after, as the impacts of climate change in the world and in our way of life impose pressing challenges to businesses and to investors looking ahead.

Much was said about this being a hypothetical concern for a distant future. Yet, research conducted by the Carbon Disclosure Project (CDP) in 2020 found that suppliers expected an increase in costs due to environmental risks amounting for US$1.26 trillion over the supply chain in the next five years, which would charge the major buyers with at least US$120 billion in additional costs. On the other hand, as society grows more aware, reputational risks increase for companies who do not recognize the relevance of environmental concerns.

There simply is no way back. The financial effects of climate change are real and amount to a very contemporary challenge, one that society progressively expects will be faced by businesses and investors.

Going beyond the ominous prognostics, it is necessary to assess the concret impact of climate change in all areas of the economic activity, to properly recognize the risks and opportunities that are emerging. These assessments will be invaluable in the pursuit of a course of action that is both sustainable and profitable.

Identifying core risks and opportunities related to environmental issues

But what shape do these risks and opportunities related to environmental issues take in day-to-day business? The Task Force on Climate-related Financial Disclosures, a group created by the Financial Stability Board, international organization of G20 and other key financial country's representatives, provides an interesting classification.

Climate-related risks

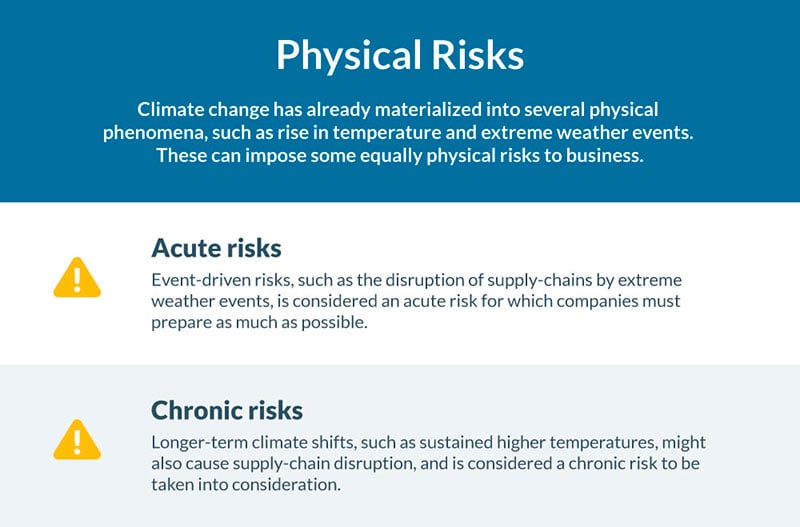

The most pressing source of concern are, of course, the risks generated by climate-change. These can be divided into transition risks and physical risks, and will be individually explained below.

Climate-related opportunities: investing in business resilience

Not all market analyses relating to environmental concerns have dire results. Several invaluable opportunities will emerge from the race towards a greener way to do business. Many of those new opportunities will involve the development of innovative products and services, with an emphasis on resource efficiency, specially on energy savings.

New investment opportunities will also arise, especially to provide financing for sustainable projects. Only in 2021 were raised US$485 billion in investments for green solutions, the so called green bonds, with an increase of 98% in comparison with the values collected in the previous year.

An intangible asset that will surely be taken into consideration by investors is the climate resilience, understood as the capacity of a business to respond to the risks mentioned above and to recognize all the market potential of greener solutions.

In this quest, a company that wishes to position itself as a climate resilient must promote a full shift of mentality and internal management. Not surprisingly, a well conducted contract lifecycle management can be a valuable asset in this quest. Here are a few ways CLM can make your company more climate resilient.

CLM beyond paper use reduction

Contracts are the primary means through which a company acts in the market. Internally, these documents are present ever since foundation, all the way up to expansion, moving through staff formation and venue rental. Externally, contracts establish the relationships between buyers and sellers, guiding expectations with regards to the products and services owed.

To make sure a contract follows all necessary requirements of both parties, as well as that it is rightly fulfilled, many companies adopt contract management initiatives. The most efficient way to manage a contract, however, is to consider every step of its lifecycle, from request to execution, on what is known as Contract Lifecycle Management, or simply CLM.

To compose the CLM strategy, enterprises are resorting to specialized software - such as netLex, to standardize and automate a contract’s lifecycle.

In the quest to become more climate resilient, companies will need all the tools they can get, and CLM is a valuable one. One of the most obvious contributions of CLM to environmental concerns is the reduction of paper use. As contracts are completely automated, being created, negotiated, signed and stored through cloud based solutions, a considerable amount of paper is saved.

That means there is no more need to print several versions of the same document for correction or signature. This reduction in paper use will surely have an impact, for example, on the carbon footprint of the company.

However, the benefits of a CLM strategy to an enterprise bent on going greener go beyond paper use reduction.

Going green through CLM

The same company may occupy different positions in different contractual relations, being, for example, the seller in one of them, and the buyer in the other. Buying and selling are both sides of the same coin, and concentrate most of the company’s carbon footprint.

According to research conducted by the CDP, supply chains can concentrate between 50% to 70% of total corporate emissions. All it takes is one look at the most common procedures involved in upstream and downstream operations to understand why: extraction of raw materials, land use or animal farming, the process of converting these into market products, packaging, transportation and storage for retailing, as well as end-of-life disposal are phases that generate considerable Greenhouse Gas (GHG) emissions.

Hence, all interactions mediated through contracts can become vehicles for a company’s environmental practices. Let’s take into consideration how your business can go greener with a good CLM software, such as netLex.

From the beginning: sustainable procurement

In procurement, even before the signing of the contract, it is important to map out environmental risks related to the product or service requested. In the case of products, for example, it is essential to make sure that the entire lifecycle is accounted for, all the way to end-of-life disposal.

In light of what was identified, all vendors must fill an environmental due diligence form, so that the procuring company can establish this as a criteria for comparing the bids and ultimately form a shortlist where all alternatives are sustainable. This evaluation can be greatly aided by looking for credible ESG certifications.

Remember: a business is only as climate resilient as its suppliers are.

CLM can make sure all the environmental due diligence forms are filled, analyzed and stored in a more efficient way. With netLex it is possible, for example, to process bids through fully automated questionnaires that can include environmental assessments. The form can vary with regards to the risks maped, and go through specific workflows depending on the inputs offered by the vendor. A high-risk investment, for instance, can go through higher levels of approval inside the company.

Drafting and managing a green contract

Whether the company is selling or buying, it will come the time when a contract must be drafted, negotiated and finally approved. At that moment, it is important to make sure that all relevant laws, regulations and company policies are properly included in the final document.

However, if this negotiation is conducted via email, with little to none version control, there is a considerable risk that important clauses might be left behind. As a result, the company becomes more susceptible to litigation or policy risks that, if materialized, can have a devastating effect on the enterprise as a whole.

Moreover, climate resilience also requires the company to have a panoramic view to manage all of its contracts, especially the ones that involve high levels of environmental risk. The enterprise must be aware, for example, of all instances of environmental risk assumption and of their estimated financial impact, to evaluate the necessity of preparing countermeasures to mitigate eventual damages.

Drafting, negotiating, approving and managing are features included in CLM that can be used to enter greener contracts. In netLex it is possible to make sure all relevant clauses are included in the final document, and to map all contracts that involve high levels of environmental risks according to the company’s internal policies and external responsibilities.

What gets measured gets managed… and accounted for

The transition to a greener way of doing business is marked by the need to redraw the company’s supply chain and internal workflows. Some suppliers will be replaced, a few demands will be reviewed and new concerns will be addressed by different areas within the enterprise. In the midst of all these changes, one might wonder how to know if the outcome is really as positive as was promised.

In order to understand and quantify the alterations promoted, it is essential to have credible data regarding the entirety of the business's operations. In the contractual fied, a CLM software capable of generating intelligence can provide such information for two purposes:

- Manage the new practices: there are several ways to internally allocate the new demands derived from the transition to more sustainable operations. The company’s management must define procedures and assignments, and should be supplied with updated information whenever needed to ground their decisions.

- Transparency: Investors, Directors and the society in general are claiming for more transparency with regards to businesses environmental policies and impacts. The means to achieve this goal is through data reports of all operations, and the management of a contract’s lifecycle is an unique opportunity to obtain such data.

With netLex it is possible to gather data from contract’s before and after the transition, so that it is viable to take better informed management decisions to improve the new procedures. The information collected will provide a clear picture of what step of the way needs to be made more efficient. Moreover, it is also possible to extract reports, so that investors can assess the concrete benefits of the transition.

The path forward is green and paved with data

Investors and society have clear expectations towards companies as prime agents in the pursuit of a more sustainable future. As environmental risks become more real, so do environmental opportunities, and climate resilient businesses will have an opportunity to thrive like no other.

The path forward is not only green, but it is also paved with data. Contracts, being the primary means through which a company acts in the market, become excellent vehicles for the new environmental practices. A good CLM software, such as netLex, is capable of including due diligence measures, filtering through high-risk contracts, managing obligations up until end-of-life disposal and much more, all this while generating intelligence.

Click here to learn more about how we can help!